Hobby Heat Check: Hank Aaron Surge, Nick Kurtz Boom & Topps Chrome Slump

The post-National market always brings a wave of recalibration, reflection, and probably for most— recovery. This year, despite some collector frustration surrounding Topps Chrome and its underwhelming rookie class, several standout performances and record-setting auctions signaled confidence in the long-term health of the baseball card market.

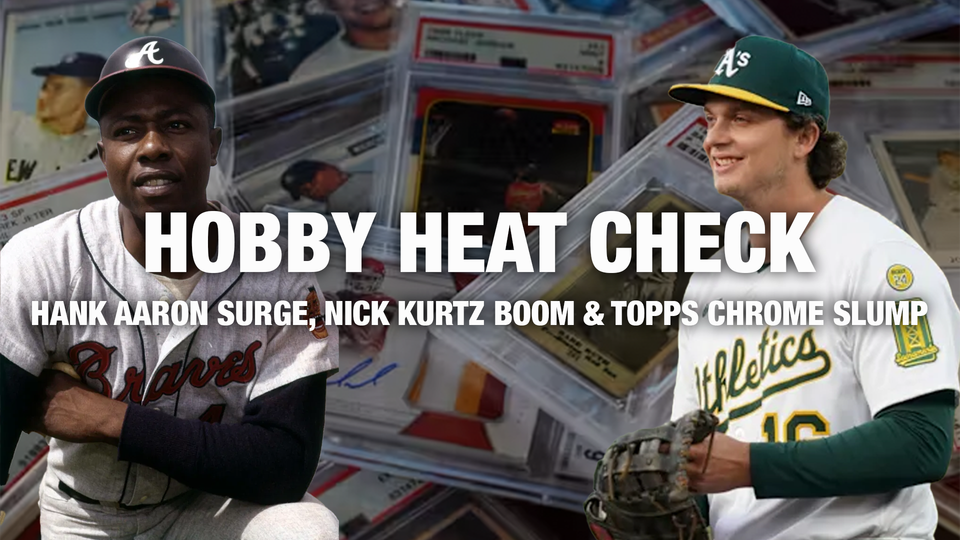

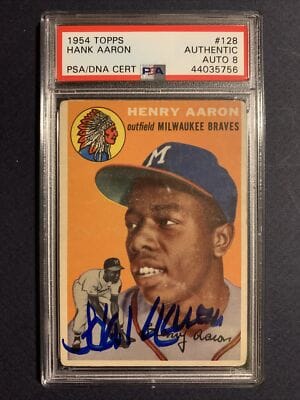

Hank Aaron's Legacy Lifts to New Heights

CardLadder shed some light on a 1954 Topps Hank Aaron rookie card (PSA 7.5, Pop 26) that sold on eBay for $30,000 in late July—an all-time high. Just five months earlier, this same grade sold for $20,750, marking a 44.6% increase.

While the card is historically significant on its own, the timing of this market movement may not be coincidental. Aaron was the centerpiece of a moving tribute during last month’s MLB All-Star Game in Atlanta, with his family present and legacy widely celebrated. For collectors—especially newer or younger ones—this kind of national media exposure often catalyzes a deeper appreciation and renewed demand.

The result?

Icon status meets modern media effects—Aaron’s market shows what happens when legacy, scarcity, economics and emotion align.

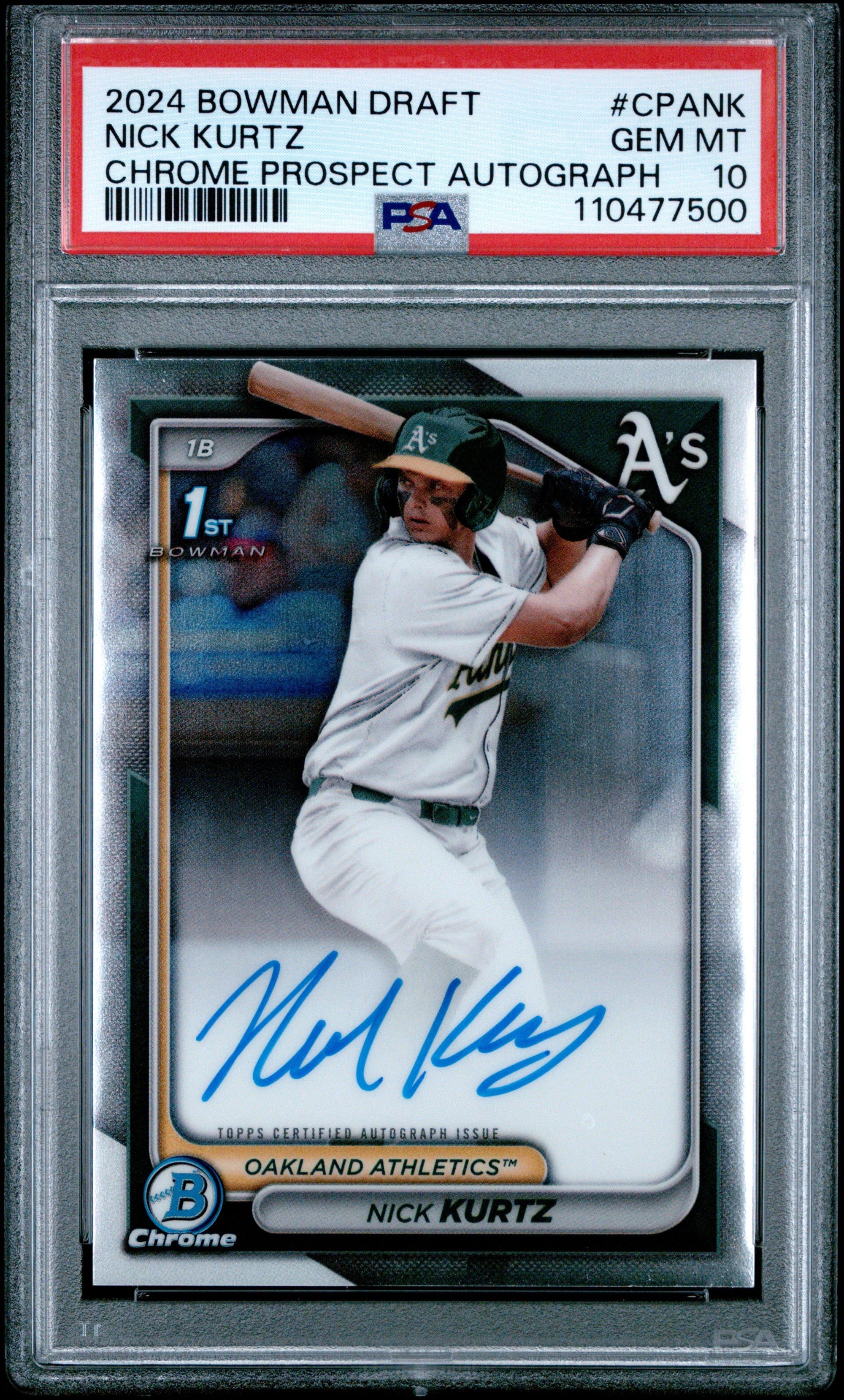

Nick Kurtz: Rookie of the Year Value Run

Nick Kurtz’s 2024 Bowman Chrome PSA 10 Auto has experienced a massive spike in value.

As recently as March–May, the card consistently sold below $200. But after his record-breaking 4-home-run game in July, prices surged to a high of $1,600, and have since settled in near $1,000. Fanatics Collect confirmed a $1,000 sale on August 3, with plenty of other sales right around that range and a CardLadder value at $845.

This represents an approximate 500-900% increase from his lowest sale in March—a remarkable surge that validates early investor conviction. Kurtz, widely considered one of the best power prospects in the 2024 draft, was a sleeper name in early breaks of Bowman releases last year. That sleeper status has now been replaced with AL Rookie of the Year frontrunner expectations.

His teammate Jacob Wilson, who held that frontrunner status for most of the season, is now out indefinitely with a fractured forearm. If Kurtz continues at this pace, a 30-homer rookie campaign feels likely—strengthening his case both on the field and in the market.

Topps Chrome Sentiment Cooling

Although Topps Chrome remains a staple product and the official introduction to MLB-uniform rookies, collector sentiment this year is a bit tepid. Conversations on the floor of The National confirmed it: some hobbyists (both breakers and collectors) feel the timing of the release and the rookie class combined is a bit underwhelming.

Let’s break it down:

- Since July 3, James Wood batting just .169 with 2 HR, 6 RBIs, and 15 hits over 23 games. Despite his immense upside and athletic profile, the Nationals’ top rookie is slumping—striking out 41 times in his last 100 plate appearances. With Chrome releasing a couple weeks ago, you’d love to see him hit his hot streak to keep everyone excited.

- Dylan Crews has been out nearly two months with an oblique injury. While he begins a Triple-A rehab stint this week, it’s likely he won’t appear in the majors until later in August, maybe even September.

- Jacob Wilson, the early AL ROY favorite, is now sidelined with a fractured forearm.

Without true breakout hobby darlings in this release—and with most of the major chase hits already pulled in the first week—the product’s value proposition has come into question.

Combine that with Jacob Misiorowski and Nick Kurtz not having rookie cards in this first wave of Topps Chrome, and you lose a little of that hype.

However, I think this sets The Hobby up for an epic fall release of Topps Chrome Update which will feature those two, and other rookies who debuted later in the season.

Oh….AND the chase of the MLB Debut patches. Buckle up.

Final Thoughts

Despite the current pressure on Topps Chrome and its checklist, the market remains resilient.

The 2025 National in Chicago was crazy crowded with record lines extending down streets outside the convention center, Tom Brady opened up a CardVault in Wrigleyville, and Topps, Panini, and other great industry giants continue to innovate and create great fan and collector experiences for everyone.

Demand across the collector spectrum—from vintage blue chips to modern prospecting—continues to grow.

These are not hype cycles. They're signals.

When cards like Hank Aaron's rookie break new ground and rookies like Nick Kurtz shift their price floors by 900% in four months, it reinforces what this market is: dynamic, emotional, and increasingly driven by both on-field performance and public narrative.

One product's dip doesn't define the market. It refocuses it.

Until next week—keep your slabs safe and your eBay notifications on.