Betting on the Midwest: Baseball’s Next Hotbed?

I came back to Chicago this summer to suit up for the Chicago Dogs, but what really pulled me in wasn’t just baseball nostalgia—it was a pattern I’d seen before.

I played in Chicago for the White Sox in 2016 and have popped in and out of the city since. Over the last few years, working on the business and marketing side of the game alongside my friend Jayson Hernandez at the Boras Corporation, Ive seen Chicago’s player-development scene begin to organize lately: more private trainers, more tech-curious coaches, more kids trying to stretch summer into twelve months.

When I got back into pro ball with the Dogs, naturally I started to figure out the midwest training protocols—indoor facilities, scheduling, tech, and feedback loops. Honestly, I expected to find a denser micro-facility map than what exists right now.

At the indy level, I felt a real data gap: fewer daily feedback loops (ball-flight and biomechanics) than I’d seen in places like Louisiana or back home in New Jersey.

To me, that’s not a problem; it’s an opportunity. Gaps like this are what hotbeds look like right before they pop.

The spark: stars clustered in the middle

Hotbeds are cultural before they’re statistical.

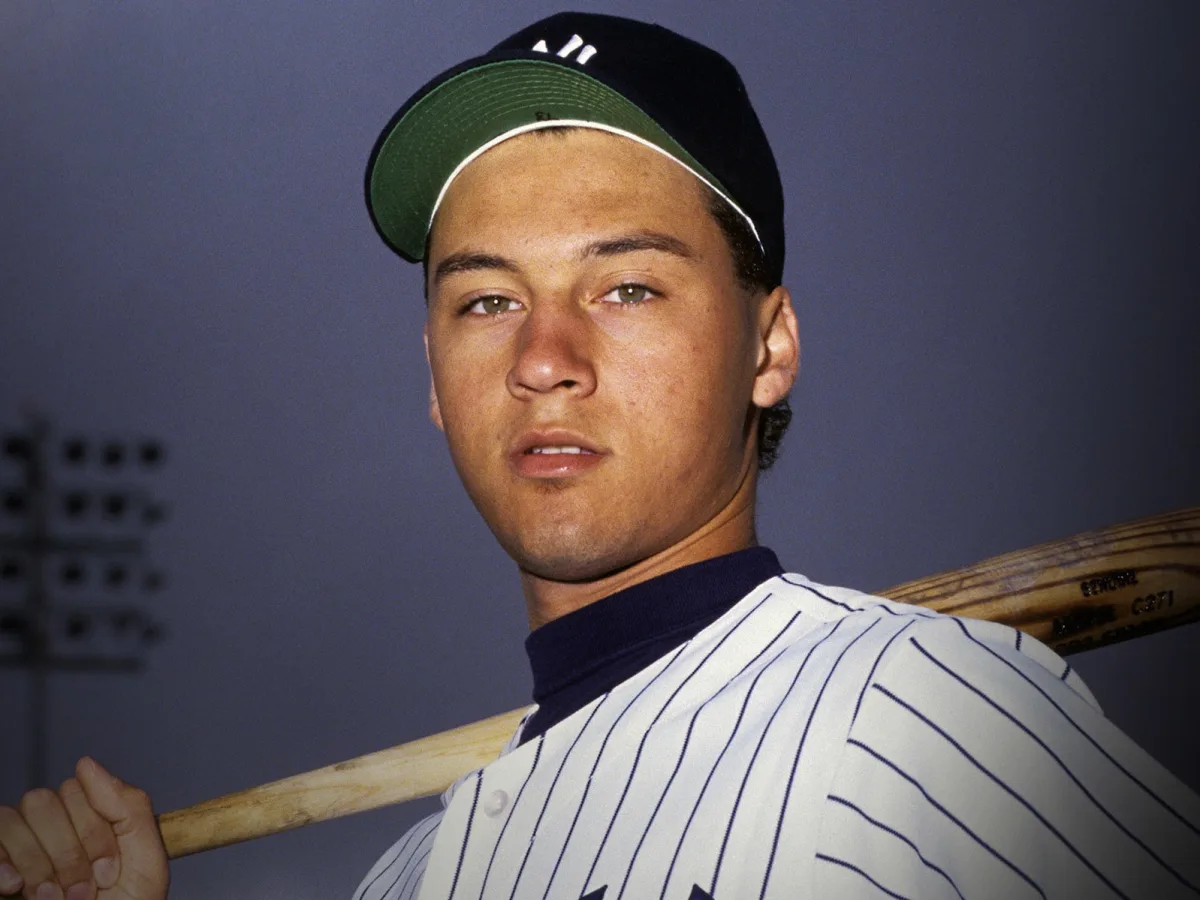

I grew up in New Jersey during the late 90’s and early 2000s, when Derek Jeter (then Todd Frazier) was the name every kid knew. The Yankees and Mets were both competing at a high level, pumping out house-hold names, and Derek Jeter was the player everyone wanted to be.

That era created a spark.

Parents invested in lessons, club teams multiplied, and indoor facilities popped up across the state because cold weather demanded it. Todd Frazier and the Toms River East Little League team became local celebrities, and Todd paved the way for every NJ kid to think the dream was possible.

Within a decade, New Jersey was pumping out professional players at a clip few would have predicted back when I was a teenager.

Fast forward to 2025— in the NL and AL Central, the stars that kids copy are already here: Paul Skenes jump-started a wave of Pirates buzz with a historic 2024 rookie season (NL Rookie of the Year, sub-2.00 ERA), while Jackson Chourio became Milwaukee’s long-horizon centerpiece after an unprecedented pre-debut extension. Add the Reds’ Elly De La Cruz and Hunter Greene and the Royals’ Bobby Witt Jr., and you have a whole region with heroes at premium positions. Throw in the minor league hype of social media starts like Max Clark and Konnor Griffin, and the vision becomes more clear.

These are the guys that make 10-year-olds beg for lessons and 40-year-olds sign up for monthly facility memberships.

I’ve seen this movie: the New Jersey playbook

I first walked into Jack Cust Baseball Academy for a lesson in 2005, and that place essentially shaped my entire recruiting journey—Super 17, NJ DiamondJacks, the whole thing.

JCBA had been there since the late 1990s; by 2009, the operation expanded into Diamond Nation in Flemington, which became a true indoor/outdoor engine for year-round baseball and softball in a cold-weather state, and the addition of Jennie Finch and softball presented a real business and growth opportunity.

In 2011, after being drafted by Boston and began my pro career, I invested in Diamond Nation.

Thirteen years later, in April 2024, we closed a successful exit to Unrivaled Sports—the youth-sports platform that includes Ripken Baseball and Cooperstown All-Star Village and has partnerships with Cal Ripken Jr. The deal underscored how valuable mature, data-driven diamond hubs have become; Diamond Nation alone was drawing 3,000+ teams and ~45,000 participants per year.

That’s the template I’m betting the Midwest will follow—potentially bigger.

The demand wave is measurable

Nationally, baseball participation hit ~16.7 million in 2023, the highest recorded since SFIA began tracking in 2008, with baseball/softball combined at ~25.3 million. Softball participation alone grew ~6% year-over-year. Those are tailwinds for every cold-weather metro that can supply indoor inventory and data-rich training.

At the high-school level, baseball sits among the most popular boys’ sports in the U.S., with ~472,000 boys participating in 2023-24—No. 4 by participants—and that anchors the local pipeline that feeds facilities all winter.

And the institutional money is following the diamond.

In 2025, MLB made a strategic investment in the Athletes Unlimited Softball League (AUSL)—the first full-scale MLB partnership with a women’s pro league—pairing marketing, distribution and development resources with a touring, multi-city season.

That’s not just a women’s-sports story; it’s a diamond-sports story that expands the shared infrastructure (fields, fans, media, tech) across baseball and softball. Importantly for the Midwest narrative, Athletes Unlimited has staged its flagship softball seasons in the Chicago area (Rosemont, IL) for years, and AUSL’s 2025 slate included Chicago-area dates and national TV coverage.

Why the Midwest is next

Here’s the loop I see forming:

- Icons → Participation. Skenes, Witt, Elly and Chourio make the Central divisions cool for kids again.

- Participation → Investment. Parents buy lessons; coaches add tech; indoor facilities multiply to fight weather.

- Investment → Development. Daily feedback loops (ball-flight, biomechanics, bat-sensor data) turn interest into outcomes.

- Outcomes → More Icons. More draft picks and college commits → more reason to reinvest.

That’s exactly how New Jersey flipped twenty years ago. Cold weather didn’t slow the boom; it forced a better business model—indoor-first, tech-heavy.

Chicago, Detroit, Milwaukee, Cincinnati, Pittsburgh, Kansas City, Minneapolis–St. Paul: these are metro areas with big baseball audiences, plenty of cold-weather days, and room for facility and technology growth.

The signal: long-term anchors across the Central

If you want to know where a baseball region is heading, follow the contracts. Extensions are a tell: they’re votes of confidence in a core that kids will emulate and local operators will build around. Here are the clearest “we’re building here” signals in the Central, with the essentials and sources:

Key Contract Extensions & Team Commitments in the Central

| Player | Team | Contract Type | Years / Structure | Notes / Signaling Value |

|---|---|---|---|---|

|

Jackson Chourio |

Milwaukee Brewers (NL Central) |

Pre-debut Long-term extension |

8 yrs (’24–’31); club options ’32–’33; $82M guaranteed; max $142.5M | Record deal for a zero-service-time player; clear face-of-franchise signal. |

|

Bobby Witt Jr. |

Kansas City Royals (AL Central) |

Extension | 11 yrs, $288.7M guaranteed; up to 14 yrs, $377.7M w/ options | Largest deal in club history; locks in a regional icon through prime. |

|

Bryan Reynolds |

Pittsburgh Pirates (NL Central) |

Extension | 8 yrs, $106.75M; team option ’31 | Longest / richest Pirates deal at signing; stabilizes lineup core. |

|

Ke’Bryan Hayes |

Cincinnati Reds (via trade from PIT) |

Extension (signed 2022 w/ PIT) |

8 yrs, $70M; club option yr 9 | Elite-defense 3B now anchors a Central rival; contract control carries over. |

|

Hunter Greene |

Cincinnati Reds (NL Central) |

Extension | 6 yrs, $53M; $21M club option ’29; max >$95M | First “core arm” locked up in the Reds’ window. |

|

Cole Ragans |

Kansas City Royals (AL Central) |

Extension | 3 yrs, $13.25M (’25–’27); + ’30 club option | Post-All-Star breakout rewarded; KC keeps future control. |

|

Colt Keith |

Detroit Tigers (AL Central) |

Extension | 6 yrs, $28.6M; club options ’30–’32; max $82M | Early buy-in on a homegrown bat; long runway of control. |

|

José Ramírez |

Cleveland Guardians (AL Central) |

Extension | 5 yrs, $124M (≈$150M incl. prior option) | Below-market superstar stays; culture anchor. |

|

Andrés Giménez |

Traded CLE → TOR (Dec 2024) |

Extension (signed 2023 w/ CLE) |

7 yrs, $106.5M; ’30 club option | Not a current Central anchor; shows CLE’s team-friendly model. |

|

Emmanuel Clase |

Cleveland Guardians (AL Central) |

Extension | 5 yrs, $20M; club options ’27–’28 | Elite closer on ultra-team-friendly terms; 2025 leave status. |

|

Luis Robert Jr. |

Chicago White Sox (AL Central) |

Extension | 6 yrs, $50M; club options ’26–’27 | Zero-service-time deal matured into MVP-caliber cornerstone. |

|

Eloy Jiménez |

Chicago White Sox (deal signed 2019) |

Extension | 6 yrs, $43M; club options ’25–’26 | Early Sox model; player no longer an active anchor. |

|

Nico Hoerner |

Chicago Cubs (NL Central) |

Extension | 3 yrs, $35M; covers arb + 1 FA yr | Glue piece; control through ’26. |

|

Ian Happ |

Chicago Cubs (NL Central) |

Extension | 3 yrs, $61M; through ’26; full NTC | Continuity for a homegrown All-Star / Gold Glover. |

Other MLB Players Under Team Control (pre-arb/arb window)

Rule of thumb shown below: control generally runs 6 MLB seasons before FA; “est.” reflects debut-date service-time nuances.

| Player | Team | MLB Debut | Control Window (est.) | Notes |

|---|---|---|---|---|

|

Paul Skenes (RHP) |

Pittsburgh Pirates |

2024 — |

through 2030 |

|

| Jared Jones (RHP) |

Pittsburgh Pirates |

2024 03-30 |

through 2029 |

|

| Elly De La Cruz (SS) |

Cincinnati Reds |

2023 06-06 |

through 2029 |

|

| Cade Horton (RHP) |

Chicago Cubs |

2025 05-10 |

through 2031 (est.) |

|

| Pete Crow-Armstrong (CF) |

Chicago Cubs |

2023 09-11 |

through 2029 |

|

| Brice Turang (2B/SS) |

Milwaukee Brewers |

2023 03-30 |

through 2028 |

|

| Jacob Misiorowski (RHP) |

Milwaukee Brewers |

2025 06-12 |

through 2031 (est.) |

|

| Bubba Chandler (RHP) |

Pittsburgh Pirates |

2025 08-22 |

through 2031 (est.) |

|

| Chad Patrick (RHP) |

Milwaukee Brewers |

2025 03-29 |

through 2030 |

Minor-League Hype: Top MLB Prospects in the Central (Aug 2025 rerank)

3 of the Top 5 and 6 of the Top 10 prospects are in AL/NL Central orgs — a strong forward indicator for the region.

| Rank | Prospect | Org (Division) | Pos. |

|---|---|---|---|

| 1 |

Konnor Griffin |

Pittsburgh Pirates (NL Central) |

SS/OF |

| 2 |

Kevin McGonigle |

Detroit Tigers (AL Central) |

SS |

| 5 |

Jesús Made |

Milwaukee Brewers (NL Central) |

SS |

| 6 |

JJ Wetherholt |

St. Louis Cardinals (NL Central) |

SS/2B |

| 7 |

Bubba Chandler |

Pittsburgh Pirates (NL Central) |

RHP |

| 9 |

Max Clark |

Detroit Tigers (AL Central) |

OF |

Note: (Eloy/Moncada) are included for context, but Moncada’s club option was declined and he signed with the Angels for 2025, and Eloy’s 2019 deal is no longer an active Sox anchor.

Why these matter: Contracts don’t win pennants by themselves, but they do four things that compound regionally:

- Stabilize identity (kids in Milwaukee now grow up “being Chourio,” just as a generation once practiced the Jeter jump-throw).

- Reduce team turnover so clubs market the same stars year-over-year.

- Signal to facility owners/instructors that demand will be durable (you can invest in a HitTrax bay or mocap rig if you believe 10 years of sellable star power is coming).

- Nudge youth participation (role models + local TV exposure = more parents investing in their kids career).

Where the opportunity lies

This summer playing ball again, I expected every corner of the midwest to have a data-rich, facility— with the players having access and being well versed in the analytics. What I found was a handful of excellent flagships…and too many opportunities to educate and build infrastructure.

By contrast, in Louisiana I saw tech-forward facilities woven into the day-to-day of local ball. In New Jersey, the indoor economy matured early—driven in part by hubs like Diamond Nation, where I’d been an athlete, then an investor.

That’s why the Midwest feels like a business thesis and a baseball thesis at once. The MLB teams are doing their part by locking in stars and competing at a high level. The missing piece is a dense mesh of training—not just a few mega-complexes, but neighborhood-scaled facilities that can deliver: pitch design for advanced pitching feedback, force-plate and ground force education, high-speed hitting technology and feedback loops, and maintenance/recovery all year round.

The customer is already in the funnel; the infrastructure and technology just isn’t common enough yet.

I’ve also gotten a front-row seat to how fast it can move when the ingredients align. My time working at Stevens Baseball Complex—with its tech stack and resources and the hands-on influence of DJ LeMahieu and a strong staff—felt like standing on the on-ramp. Combine that blueprint with Chicagoland’s population density and the talent quietly pooling in the midwest, and you’ve got the beginnings of a regional powerhouse.

I’ve been both product and producer in this space—athlete, investor, coach, operator.

From my first lesson at Diamond Nation (2005) to investing there in 2011 to a successful 2024 exit, the pattern I lived is the pattern I’m betting on in the Midwest now. With roots in Chicago (CWS 2016, Dogs 2025), real work in metro Detroit, and a seat at Stevens to keep my finger on the tech and training pulse, this is where I want to plant.

Call it the Midwest Movement, whatever it is— local stars under contract, kids with someone to emulate, and an indoor facility and economy ready to absorb the demand.

So yes, I’ve seen this movie. I know how it ends if we execute: more packed mounds and cages in December and January, more college commits and pro players, and, a lot more Central Division logos on All-Star Weekend.

Sources

- MLB.com — Paul Skenes rookie season coverage, contract extensions (Chourio, Witt Jr., Reynolds, Hayes, Greene, Keith, Ramírez, Giménez, Clase, Robert Jr., Jiménez, Hoerner, Happ) and Central Division prospect rankings

- ESPN.com — Player contract details and analysis (Ramírez, Witt Jr.)

- Reuters — Cole Ragans extension reporting

- PR Newswire — Unrivaled Sports acquisition of Diamond Nation (April 2024)

- Diamond Nation — Facility history and programming (NJ Diamond Jacks, Super 17, expansion to softball with Jennie Finch)

- NFHS (National Federation of State High School Associations) — 2023–24 high school sports participation data

- SFIA (Sports & Fitness Industry Association) — 2023 national baseball and softball participation report

- Baseball Reference — Player debut and service-time control (Chad Patrick, others)

- Athletes Unlimited / MLB.com — MLB partnership with AUSL, Chicago area events and coverage